The Reasoning Behind Unlevered Free Cash Flow (and How to Calculate It)

Unlevered Free Cash Flows (UFCF) refer to the cash flow available to all equity holders and debtholders after accounting for operating expenses, capital expenditures, and investments in working capital. This theoretical corporate finance figure is crucial in financial modeling as it helps determine a company's enterprise value without considering the impact of its capital structure. In essence, it shows how much cash flow equity and debt holders can access from business operations.

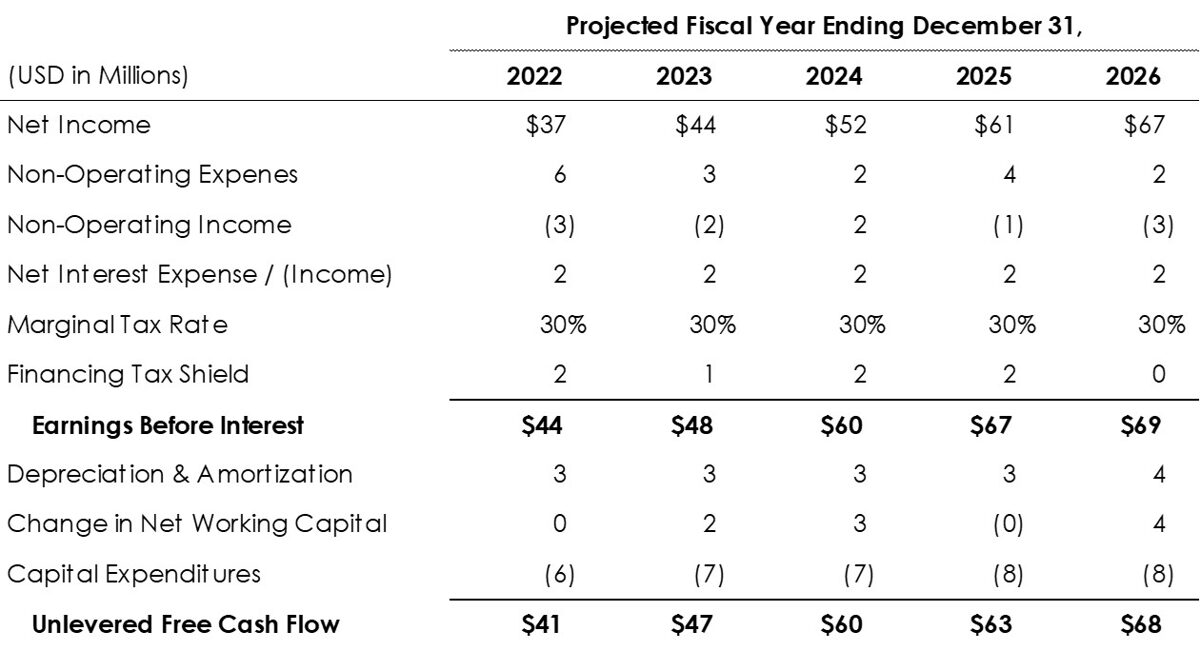

To calculate a company's UFCF, we can use either EBITDA or net income as a starting point. In both cases, the first step is to arrive at EBI (earnings before interest) more commonly known as NOPAT (net operating profit after tax). EBI measures a company's profitability after tax without considering its capital structure.

If you begin with EBITDA, you can subtract depreciation, amortization, and taxes to get to EBI. Pretty straightforward.

EBI = (EBITDA - Depreciation - Amortization) * (1 - Marginal Tax Rate) or

EBI = EBIT * (1- Marginal Tax Rate)

If you start with Net Income, you must adjust for interest expense and non-recurring, non-core operation income and expenses, including the tax shield, and work your way back to EBI.

EBI = Net Income + Adjustments (net of tax shield)

Adjustments = (Interest Expense - Interest Income - Non-Operating Income + Non-Operating Expenses) x (1 - Marginal Tax Rate)

Although EBI is a valuable metric for measuring an organization's operating profitability, it does not accurately reflect cash flow. This is because EBI incorporates non-cash expenses, such as depreciation and amortization, which need to be added back. Furthermore, EBI fails to consider any changes in working capital or capital expenditures directly affecting an organization's cash flow.

The final adjustments required to arrive at the UFCF are visible in the following formula:

EBIDA = EBI + Depreciation + Amoritzation

Unlevered Free Cash Flow = EBIDA - Change in Net Working Capital - Capital Expenditures

Understanding how to calculate a company's unlevered free cash flow is crucial in financial modeling. By conducting a discounted cash flow analysis on a firm's unleveraged free cash flows, you can calculate a company's enterprise value for M&A purposes and compare its valuation to that of other similar firms.

Below is an example of the how to get to unlevered free cash flow starting from net income.