Exploring the Impact of Capex on a DCF Valuation

Capital expenditures, or "capex," play a crucial role in the discounted cash flow (DCF) valuation method and can significantly impact the assessed value of a business or an investment. Understanding how capex influences DCF valuation is essential for investors, financial analysts, and business owners.

Capex refers to the investments made by a company in long-term assets such as property, plant, equipment, and other infrastructure. These investments aim to improve or expand the business's productive capacity and are vital for its growth and competitiveness. In a DCF valuation, capex is a key consideration that directly affects the calculation of free cash flows, which are fundamental to the DCF model.

When performing a DCF analysis, projected future cash flows are estimated and discounted to their present value. Capex impacts DCF valuation in several ways:

1. Free Cash Flow Projection: Capex directly impacts the calculation of free cash flow by reducing the amount of cash available to the business for other purposes, such as debt repayment, dividends, or reinvestment. Higher capex leads to lower free cash flows, which can lower the overall valuation of the business.

2. Growth Prospects: Capex is closely linked to a company's growth prospects. Higher levels of capital investment typically signal that the company is investing in its future growth, which can positively influence the DCF valuation by reflecting the potential for increased future cash flows.

3. Maintenance vs. Growth Capex: Distinguishing between maintenance capex (related to the upkeep of existing assets) and growth capex (related to expansion and improvement of assets) is critical in DCF valuation. While maintenance capex is essential for sustaining current operations and cash flows, growth capex represents investments in future growth opportunities. It's essential to carefully consider the nature and impact of each type of capex when projecting cash flows.

4. Terminal Value: Capex also affects the terminal value, which represents the value of a business beyond the explicit forecast period and is a significant component of DCF valuation. Higher or lower capex levels can impact the terminal value by influencing the projected cash flows and the perpetuity growth rate used in the DCF model. A normalization adjustment of the terminal year's cash flow is recommended to avoid overestimating or underestimating the terminal value.

In conclusion, the impact of capex on DCF valuation is multifaceted, and careful consideration of capex assumptions is crucial for an accurate valuation. Financial analysts and investors must assess a company's capital allocation decisions, investment strategy, and the nature of its capex to make informed judgments about its value. By recognizing the significance of capex and its implications for cash flows and growth prospects, stakeholders can enhance the reliability and accuracy of DCF valuations.

Why Do Some Companies Trade at Higher Valuation Multiples?

Companies trade at different valuation multiples due to various company-specific and external factors. At its core, multiples reflect an investor's perceived risk-adjusted returns in a company. The higher the risk, the lower the value multiple because an investor is willing to pay less for the investment to ensure a higher ultimate return. The most typical valuation multiples are price-to-earnings (P/E), enterprise value-to-sales (EV/S), and enterprise value-to-EBITDA (EV/EBITDA), which investors use to gauge the relative value of a company's stock.

The growth prospects of a company significantly influence its relative valuation. A company with strong growth potential is likely to have a higher valuation multiple, as investors are willing to pay more for the expectation of greater future earnings. The example below shows two companies (A and B) with the same EBITDA as the starting point, but one is growing significantly faster than the other. Requiring the same return on investment, you should be willing to pay more for the faster-growing company. At a comparable 30% investment yield, Company B's implied enterprise value would be significantly lower, leading to a lower multiple.

Obviously, the market rewards growth, which is reflected in a premium. If you look at current EBITDA, you would be paying a higher multiple today for Company A, but considering forward-looking multiples, then an investment in Company A may be cheaper on a relative basis.

The industry in which a company operates significantly influences its valuation multiple. Idiosyncratic risk, sector cyclicality, market saturation stage, cost structure, capital requirements, and market correlation are all industry-specific and affect how investors value companies. For example, tech companies often trade at higher multiples due to their growth and scalability, while utilities typically trade at lower multiples due to their predictable yet limited growth potential. Familiarity with industry-specific dynamics is crucial for understanding the risks-reward profile before investing in a company.

Furthermore, profitability and financial health are crucial factors impacting valuation multiples. Companies with strong and consistent profitability, healthy balance sheets, and efficient capital deployment will likely command higher multiples. Conversely, companies with volatile earnings, high debt levels, or poor cash flow generation may trade at lower multiples as investors perceive higher risk.

Finally, external factors, such as market sentiment and macroeconomic conditions, also contribute to differences in valuation multiples. For instance, higher interest rates reduce valuations and compress multiples universally but may impact certain companies or industries more. Additionally, when future earnings growth is in jeopardy during economic uncertainty, investors tend to be more cautious and value companies at lower multiples. Conversely, in optimistic market conditions, companies may be valued at higher multiples in anticipation of faster and higher earnings.

In conclusion, companies trade at different valuation multiples mainly due to growth prospects, industry dynamics, profitability, financial health, and macroeconomic factors. Understanding these factors is essential for investors seeking to make informed decisions about the relative value of different companies.

What is the Cash Conversion Cycle, and how Does it Impact Working Capital Management?

Working capital is a financial metric calculated as the difference between current assets and current liabilities. If a company has a positive working capital balance, it can cover day-to-day expenses and short-term obligations at that particular point in time. Effectively managing working capital is important because it directly affects the company’s operating cash flow.

One of the key metrics in working capital management is the cash conversion cycle (CCC). In this article, we'll discuss the importance of the CCC and how it impacts working capital management.

What is the cash conversion cycle?

The cash conversion cycle (CCC) measures the time it takes for a company to convert inventory into cash, indicating the efficiency of working capital. It includes three key components: the days inventory outstanding (DIO), the days sales outstanding (DSO), and the days payable outstanding (DPO). DIO measures the number of days it takes for a company to sell its inventory. DSO measures the number of days it takes for a company to collect payment from its customers. DPO measures the number of days it takes for a company to pay its suppliers.

The formula for calculating the CCC is as follows:

CCC = DIO + DSO - DPO

A shorter CCC means a company is quicker and more efficient at managing its working capital, while a longer cycle indicates the opposite.

How does the CCC impact working capital management?

A longer CCC means that a company has more cash tied up in inventory, accounts receivable, and accounts payable, negatively impacting a company’s cash flow. For example, if a company has a high DIO, its inventory sits on shelves for longer, tying up cash that could be used for other purposes. Similarly, if a company has a high DSO, it takes longer to collect payment from customers, also tying up cash flow. Lastly, if a company has a low DPO, it pays its suppliers quickly, negatively impacting cash flow.

Alternatively, by reducing the time it takes to convert inventory into cash, a company can generate cash flow quicker (or free up cash tied in inventory or accounts receivable) that can be used for other purposes, such as investing in growth opportunities or paying down debt. Similarly, by increasing the time it takes to pay suppliers, a company can reduce cash flow outflows (by holding on to cash payable for longer) and improve its overall cash flow.

The CCC can assist managers in making strategic decisions and identifying areas for improvement, such as enhancing accounts receivable processes or implementing more efficient inventory management.

Furthermore, the cash conversion cycle is an important working capital metric for all companies that buy and manage inventory. It provides insight into operational efficiency, liquidity risk, and overall financial health. However, it is important to analyze it in conjunction with other financial metrics rather than in isolation.

What is Debt Restructuring?

Debt restructuring is a process that companies undergo when they cannot meet their financial obligations as they come due. It involves altering the terms of the company's existing debt to make repayment more manageable. This can be done by adjusting the interest rate, extending the repayment term, or reducing the principal amount owed. Successful debt restructurings or business recapitalizations are generally good options before declaring bankruptcy.

There are two main reasons why a company may need to restructure its debt. One common cause is a decline in revenue. If a company's revenue decreases, so does its cash flow, causing it to struggle to meet its debt obligations. A revenue decline can happen for various reasons, such as increased competition, economic downturns, or changes in consumer preferences.

The other reason a company may need to restructure is high debt levels. If a company has taken on too much debt relative to its cash flow, it may be difficult to make its debt payments. This can lead to a downward spiral, making the company's debt burden increasingly unsustainable.

If a debt restructuring does not seem like a viable option, as it only delays the problem and causes the remaining equity in the business to erode, then a better way to move forward is to improve the balance sheet through a recapitalization. This would involve replacing all or part of the existing debt with fresh capital. This would help the business to eliminate or reduce the debt burden, enabling it to generate enough cash flow to stay alive and eventually grow out of its proverbial “hole”. However, this would mean taking a new equity partner in the business, which is something the business owner would have to evaluate

Overall, debt restructuring is a process designed to help companies manage their debt obligations when they are struggling financially. While it can be a difficult process, it can also be an effective way to help companies get back on track and become financially stable once again. The key to avoiding financial distress is to proactively manage the business's cash flows to ensure a proper coverage ratio against the company’s debt obligations.

What is Depreciation and How Does It Impact a Company's Valuation?

Depreciation is an expense that gradually decreases an asset's book value over its useful lifespan. It is different from typical expenses as it is a non-cash expense that is estimated years in advance. When a company buys an asset, its bookkeeper or CPA must determine its useful lifespan, salvage value, and depreciation methodology to calculate the annual depreciation amount over its useful life. It is essential for all financial analysts to understand the concept of depreciation as it appears in all three main financial statements: the income statement, balance sheet, and cash flow statement.

To understand how depreciation is calculated, let's consider an example. Suppose a company purchases factory equipment for $50,000 and plans to use it for the next four years. At the end of its useful life, the asset's market value, known as the salvage value, is estimated to be $10,000. To calculate the annual depreciation of the asset, we subtract the salvage value from the purchase price and divide it by the asset's useful life. The formula for this calculation is as follows:

(Purchase Price of the Asset - Salvage Value) divided by Useful Life

or

($50,000 - $10,000) divided by 4

resulting in

$10,000 of depreciation expense per year for 4 years

The expense of $10,000 would be reflected in the income statement. Additionally, the fixed asset account in the balance sheet would decrease by $10,000 annually. By the end of the fourth year, most of the equipment cost would be accounted for, and its book value would equal the salvage value of $10,000.

Why is Depreciation Important in Assessing a Company’s Value?

Depreciation is an important concept in accounting as it allows businesses to spread out the cost of an asset over its useful life instead of recording the entire cost in one year. This helps to ensure that the business's expenses are accurately matched with the revenue generated from the asset over time. By depreciating an asset, a business can reduce its taxable income, lowering its tax liability. Additionally, depreciation helps businesses recognize the decline in value of their assets over time, which is vital in assessing their financial position and deciding when to replace the asset.

Furthermore, depreciation affects a company's earnings and cash flow, which is essential for valuation analysis. Depreciation is a non-cash expense that reduces a company's reported earnings but does not affect its cash flow. Adjusting for depreciation can help assess a company's profitability and cash-generating ability. This is particularly important in industries where companies rely on significant investments in fixed assets, such as manufacturing or transportation.

In summary, understanding depreciation is crucial as it affects the book value of assets, earnings, and cash flow, which are key factors in a company's valuation analysis.

Why Are Commercial Real Estate Syndications Failing in the Current Market? (Hint: Interest Rates📈)

Before the rate hikes, many investors funded their real estate acquisitions with inexpensive bridge loans at very high loan-to-value ratios (LTV or the loan amount divided by the asset's purchase price). So, if a building costs $100 million to acquire, then a 90% LTV would mean that $90 million would be covered by a bank loan, while the remaining amount would be financed by equity.

A bridge loan is a type of loan commonly used to cover the gap between an asset acquisition and the point where cash flow is stable and predictable. Unlike a mortgage on a house, which usually takes 15 to 30 years to amortize, a bridge loan is used strategically to fund short-term needs. The idea is that the property is stabilized and value is maximized, developers or investors can refinance at better terms due to consistent cash flows.

Investors are facing significant issues due to high interest rates. First, the value of their assets has decreased considerably due to higher discount rates. Second, banks have become more conservative in their loan underwriting policies, increasing the debt service coverage ratios (DSCR) and decreasing loan-to-value (LTV) ratios. In our earlier example, the building that was once worth $100 million is now valued at $80 million due to a higher discount rate. If that wasn't bad enough, now banks are only willing to refinance the building up to 70% LTV or $56 million. This would mean you would still owe $34 million to the bank that gave you the initial $90 million, making refinancing impossible.

Lastly, even if you could obtain new debt to take out the initial bank, you would still have to pay higher debt service costs at relatively unfavorable terms. This would significantly impact the project's cash flows, hurting its overall returns.

So what are real estate investors doing? 1) negotiating an extension with banks, 2) selling the asset at a loss, or 3) restructuring the deal with new equity capital.

There may be worse to come, but eventually, it will pass like other previous market cycles. The next few years may present tremendous buying opportunities for investors with cash who know how to underwrite deals. I know I'm bullish.

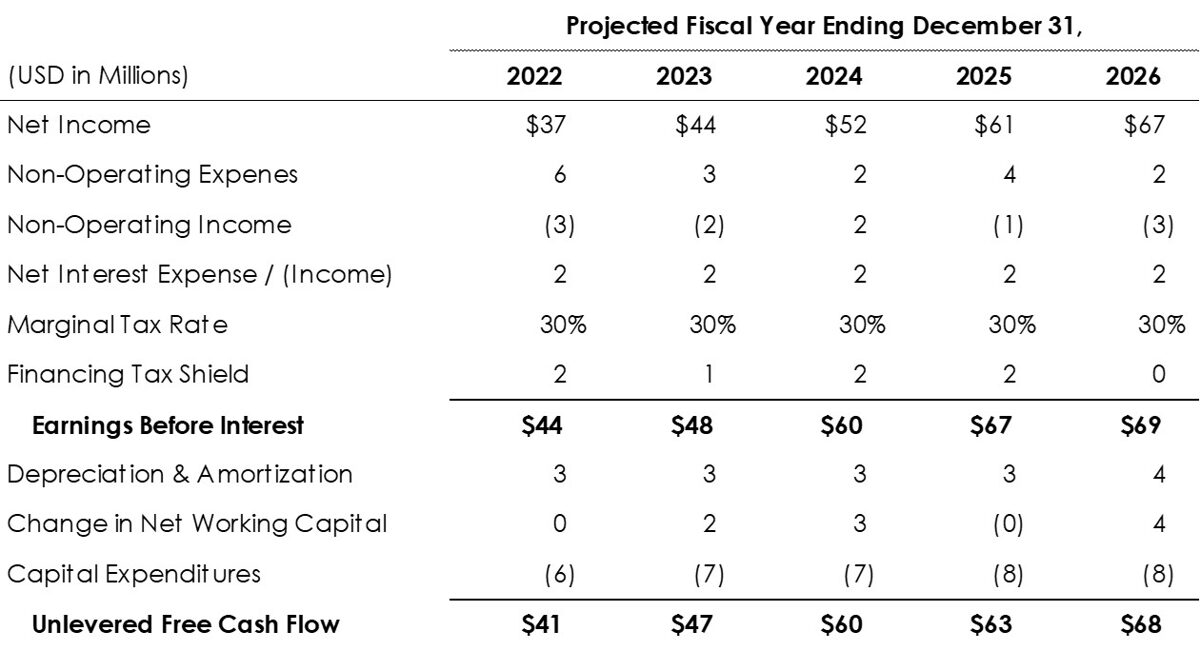

The Reasoning Behind Unlevered Free Cash Flow (and How to Calculate It)

Unlevered Free Cash Flows (UFCF) refer to the cash flow available to all equity holders and debtholders after accounting for operating expenses, capital expenditures, and investments in working capital. This theoretical corporate finance figure is crucial in financial modeling as it helps determine a company's enterprise value without considering the impact of its capital structure. In essence, it shows how much cash flow equity and debt holders can access from business operations.

To calculate a company's UFCF, we can use either EBITDA or net income as a starting point. In both cases, the first step is to arrive at EBI (earnings before interest) more commonly known as NOPAT (net operating profit after tax). EBI measures a company's profitability after tax without considering its capital structure.

If you begin with EBITDA, you can subtract depreciation, amortization, and taxes to get to EBI. Pretty straightforward.

EBI = (EBITDA - Depreciation - Amortization) * (1 - Marginal Tax Rate) or

EBI = EBIT * (1- Marginal Tax Rate)

If you start with Net Income, you must adjust for interest expense and non-recurring, non-core operation income and expenses, including the tax shield, and work your way back to EBI.

EBI = Net Income + Adjustments (net of tax shield)

Adjustments = (Interest Expense - Interest Income - Non-Operating Income + Non-Operating Expenses) x (1 - Marginal Tax Rate)

Although EBI is a valuable metric for measuring an organization's operating profitability, it does not accurately reflect cash flow. This is because EBI incorporates non-cash expenses, such as depreciation and amortization, which need to be added back. Furthermore, EBI fails to consider any changes in working capital or capital expenditures directly affecting an organization's cash flow.

The final adjustments required to arrive at the UFCF are visible in the following formula:

EBIDA = EBI + Depreciation + Amoritzation

Unlevered Free Cash Flow = EBIDA - Change in Net Working Capital - Capital Expenditures

Understanding how to calculate a company's unlevered free cash flow is crucial in financial modeling. By conducting a discounted cash flow analysis on a firm's unleveraged free cash flows, you can calculate a company's enterprise value for M&A purposes and compare its valuation to that of other similar firms.

Below is an example of the how to get to unlevered free cash flow starting from net income.

Understanding Equity Value vs. Enterprise Value: What's the Difference?

Business owners need to understand the distinction between equity and enterprise value when selling a business. Although these terms are sometimes used interchangeably, they refer to different things. This article aims to clarify the differences between these two valuation concepts and explain why they are crucial for valuation purposes.

Equity value represents the value of a company's shares. For public companies, the equity value or market capitalization is calculated by multiplying the outstanding shares by the market price per share. For private companies, the fair market value of the company’s equity can be derived by discounting the projected future dividends of a company, also known as a Dividend Discount Model (DDM).

Here are some ways to compute Equity Value:

Equity Value = Number of Outstanding Shares x Market Price per Share (for public companies)

Equity Value = Enterprise Value - Total Net Debt

Dividend Discount Model (for private companies)

In M&A, the equity value represents the purchase price or the value shareholders would receive if the company were sold.

Enterprise value measures a company's total value, including debt. It represents the amount of money that would need to be paid to acquire the entire company, assuming all its debt obligations. The enterprise value of a public company is calculated by adding its market capitalization to its net debt. Private companies can obtain the enterprise value through a discounted cash flow analysis (DCF) or comparable company valuation multiples.

Here are some ways to calculate Enterprise Value:

Enterprise Value = Equity Value + Total Net Debt

Discounted Cash Flow Analysis (for private companies)

Comparable Company Valuation Multiples (for private companies)

Enterprise value is a more comprehensive measure than equity value as it considers debt. This means that enterprise value is capital structure neutral, making it suitable for relative valuation and comparisons among different companies. For this reason, enterprise value is widely used in valuation multiples, while equity value multiples are used to a lesser extent. The limitation of equity value multiples is that financing decisions directly impact them, which can distort them due to capital structure differences rather than operating performance.

As a business owner, it is essential to understand the concepts of enterprise value and equity value in an M&A transaction. These two concepts are related and can provide different perspectives on your business's value. A good understanding of these concepts will be helpful when dealing with an M&A transaction.

7 Things to Consider When Investing in Real Estate

Evaluating a real estate deal involves assessing the potential return on investment and the level of risk involved. Here are some key factors to consider when evaluating a real estate deal:

1."Location, location, location". Location is vital because it affects the property’s appreciation potential and ability to generate income consistently. Therefore, it is essential to consider properties in up-and-coming city areas with attractive school districts, convenient transportation access, and other neighborhood amenities.

In some cases, investing in class-A markets or the best areas of a city may not be financially viable as they are usually the most expensive. However, if the returns are significant enough to justify the increased risk, then it may make sense to invest in class-B or class-C markets instead.

Pro tip: Talk to local officials about potential zoning changes and upcoming projects in your area of interest that may affect the property’s value in the future.

2. Vintage Just Means Old. The condition of a property is as crucial as its location when generating rental income. Underestimating the capital needed to improve a property can result in significant financial losses for real estate investors. It is crucial to be cautious of older properties that have not been well-maintained. Instead, focus on properties in good condition or those that can be easily renovated or repaired to increase their value.

Pro tip: It's always a good idea to walk the property before buying it (believe it or not some investors just trust their brokers). If needed, hire an inspector to assess essential high-cost items like HVAC, plumbing, electrical, foundation, structure and roof.

3. A Good Tenant is Priceless. If you're planning to buy a rental property, assessing the rent income potential is essential based on current market comparables. Look for properties in locations where there is high demand for rental units. In some cases, renting the property slightly below market rates may be beneficial to attract an ideal long-term tenant. Having vacancies kills returns.

Pro tip: Find self-managed properties (vs professionally managed) with below-market rents. Avoid bad neighborhoods at all costs.

4. Cash is King. To determine a property's cash flow potential, you must estimate its income and expenses. Income includes rent, pass-through expenses and other tenant fees. Expenses include taxes, insurance, maintenance and repair costs, property management fees, and mortgage payments if you use debt to acquire the property.

Pro tip: Having updated tax information is key when underwriting a property. Check with the city or county appraisal district to confirm the tax amount after the close, as transactions will reset the city's assessed value. This is recommended because the seller may have had some tax exemptions for which the buyer might not be eligible. Never believe the seller’s broker's numbers! Do your homework. Always inquire about any prior flooding or natural hazards from the neighbors.

5. Respect Leverage. While banks may be willing to lend you more, it's wise to consider a conservative loan-to-value (LTV) ratio. This ensures that you can make debt payments with the projected cash flows.

Pro tip: To ensure that a property is profitable, a quick rule of thumb is to ensure that its stabilized cap rate (the net operating income divided by the total purchase price) is higher than the loan's interest rate. If the loan's interest rate exceeds the property's stabilized cap rate, the property will likely experience negative leverage. This means that only the bank will make money from the investment, and you will lose money.

6. Market Sentiment. To determine whether it is a buyer's market, you need to assess the current macroeconomic conditions such as interest rates and unemployment trends, along with the local supply and demand dynamics. If it is a buyer's market, you can be more aggressive with your purchase offers. However, if the market is too hot, waiting for a few months might be better.

Pro tip: Pay close attention to the local news and take the national news with a grain of salt.

7. Exit strategy. Have a clear exit strategy, whether selling the property for a profit, refinancing to access equity, or holding onto the property for long-term rental income.

Pro tip: Look for assets that offer multiple exit opportunities. For instance, if you plan to fix and flip a house, make sure you can rent it out or use it for personal enjoyment in case the market takes a turn. This will help you avoid being stuck in an unfavorable situation.

By carefully evaluating these factors and conducting thorough due diligence, you can make informed decisions and minimize risk when investing in real estate.

How do Private Equity Investors Generate Returns?

In short, private equity firms invest in private companies to improve their financial performance and ultimately sell them for a profit. Investors typically use a combination of debt and equity financing to acquire a controlling stake in a company and then work closely with management to implement changes that increase the company's value. Traditionally, a private equity investor’s value creation playbook includes three main return drivers: EBITDA growth, multiple expansion and debt repayment.

From an operational perspective, the primary driver of returns is the growth of EBITDA, an acronym for 'earnings before interest, taxes, depreciation, and amortization'. EBITDA is a profitability metric that measures a company's ability to generate cash flows. While revenue growth is one avenue to bolster EBITDA, it can also be enhanced by addressing cost inefficiencies and operational weaknesses, often a more secure and preferred approach. Acquisition multiples are frequently computed based on a company's EBITDA, implying that any surge in EBITDA translates into a corresponding increase in the company's valuation and, consequently, the investor's equity.

Private equity firms seek to increase the value of their companies by selling them at a higher exit multiple than the original purchase multiple. However, investors do not have complete control over their exit multiples. Factors such as investor sentiment and macroeconomic conditions like higher interest rates can affect the exit multiple. Fortunately, investors can influence the exit multiple by creating favorable transaction conditions. This includes showcasing the company in the best possible light to command a premium over industry peers and conducting a competitive auction led by strategic bidders.

Investors often use leverage or debt to boost the returns on their equity. The more debt you employ, the less equity you need. The leverage you use to purchase a company will depend on its ability to repay the debt through its operating cash flow. Deleveraging refers to gradually reducing a company's debt during the holding period. As the company's debt balance decreases, the value of the investors' equity increases.

In conclusion, private equity investing can be very profitable for financially savvy investors with expertise in the industry and operations. To generate attractive returns, investors must use leverage intelligently, have the ability to identify and improve operational weaknesses, and strategically position the company to maximize the exit multiple.

Splitting Up Equity in a New Venture

When forming a business venture with a partner, one of the most important decisions is how to split the new company's equity between the two parties. In many cases, partners may agree to divide the equity equally, 50-50, for simplicity's sake but this is not always a good idea. Doing so may be unfair to one of the parties and detrimental to the business itself. Although there’s no textbook approach to splitting equity, thoughtfully analyzing each partner's contributions is recommended before signing the partnership agreement.

While cash is undoubtedly essential, other factors such as sweat equity, resources (labor, technology), experience, direct sale contributions and industry connections must also be factored into the equation when calculating each partner's contributions to the business.

One approach to determining the right equity split is listing every partner’s contribution and assigning a monetary value to each item. Both partners should discuss each other's contributions and mutually agree on the estimated value contribution for the partnership. Subsequently, each contribution item can be ranked and weighted to obtain a final adjusted contribution amount. For example, the cash contributed upon the formation of the business should be weighed more heavily than an intangible such as potential future sales. These criteria are subjective and can be negotiated and agreed upon by the partners. The idea is to quantify some of the more qualitative aspects and be on the same page.

In the example below, a business requires $400,000 to launch, and one of the partners invests 75% of the capital while the other partner puts in her time with her stellar track record. They are a great fit and the more interdependent they are of one another, the more equitable the split should be.

Partner A contributed 75% of the cash to form the business but ended up with a 66.1% ownership percentage when all factors were considered.

One of the key advantages of conducting this exercise is that it compels both parties to openly express their opinions on how each can contribute to the business, and ensures that everyone is compensated fairly. Remember, for a partnership to work, both parties must be happy and motivated, so strive to balance fairness while keeping the other party satisfied. If you struggle to compromise with your partner at this stage, it might indicate that the partnership will likely fail.

Why is Financial Due Diligence Important in M&A?

Here are a few items to take into consideration when reviewing the income statement:

Decreasing revenues; inconsistent margins

Failed budget revenue goals

Discount and warranty policies

Seasonality impact

Price sensitivity to changes in market conditions

Product mix; distribution channels

Customer concentration and significant customer contracts

Revenue recognition

Cost of goods sold composition

Variable and fixed costs

Selling general and administrative costs

Extraordinary, non-recurring and non-business items

Accounting errors

The balance sheet is just as important as the income statement during due diligence because it provides a snapshot of the company's financial position at a specific point in time. It outlines the company's assets, liabilities, and equity, essential for analyzing its financial health, liquidity, and solvency. The goal is to determine the value of the net assets that will be acquired.

At a minimum, a buyer should consider the following balance sheet information:

Operating working capital levels

Intercompany and related party transactions that are not market value

Deterioration of buildings, machinery and equipment

Inadequate reserves of obsolete inventory, excess inventory

Uncollectible accounts receivable, unidentified deposits, other reserves

Deferred assets and liabilities

Restricted cash

Debt covenants and other third-party restrictions on the company's assets

Pending litigation

Employee-related obligations and benefits, pension plans

By thoroughly analyzing the income statement and balance sheet, an acquirer can identify any potential risks or red flags and decide whether to pursue the transaction. Ultimately, financial due diligence aims to determine if the intended purchase price is reasonable, realistic and makes strategic sense.

What is Corporate Development as a Service?

Corporate development is the set of activities that a company carries out to grow and improve its business. This can include mergers and acquisitions, investments in new technologies, partnerships with other companies, and other strategic initiatives. The goal of corporate development is to help a company achieve its long-term goals and create value for its shareholders. It involves careful planning, analysis, and execution to ensure that the company is making the best use of its resources and opportunities. However, building and maintaining an in-house team can be costly and time-consuming. Outsourcing your corporate development department can bring a host of benefits to your company.

First, it lets you focus on your core business while leaving the development work to experts. This means you can allocate your resources more efficiently and effectively, resulting in higher productivity for your business.

Outsourcing this functional area can also provide access to a broader talent pool, allowing you to work with professionals with specialized skills and experience. This can be particularly beneficial for companies looking to grow inorganically through M&A or engage in strategic partnerships.

Additionally, outsourcing also provides flexibility in terms of staffing. You can scale up or down as needed, depending on the demands of your business, without worrying about the costs and complexities of hiring and firing employees. This can be particularly useful for businesses and family offices looking to grow via a one-off transaction, investment, or partnership and don't necessarily have recurring growth opportunities to execute.

Finally, another benefit of using an external corporate development advisor is cost savings. Outsourcing can be significantly cheaper than building an in-house team, as you don't have to worry about the costs of hiring and training employees, providing benefits, or maintaining office space and equipment.

Of course, there are some drawbacks to using external resources for advisory and execution. Communication can be more challenging when working with a remote team, and there may be concerns about intellectual property and data security. However, these risks can be mitigated by working with a reputable outsourcing partner and implementing strong security measures.

Overall, outsourcing your corporate development department can be a smart business decision for many companies and family offices. It allows you to focus on your core business, access a wider talent pool, scale your staffing as needed, and save money. If you're considering outsourcing, be sure to do your research and find a partner who can provide the expertise and support you need to succeed.

What is the Weighted Average Cost of Capital (WACC)?

When a company needs to raise capital, it has various options, such as borrowing from a bank or issuing debt or equity from the private or public markets. However, each financing option has a cost, and it is not always clear which option is the most cost-effective. This is where the weighted average cost of capital (WACC) comes into play.

WACC is a financial metric that represents the average cost of all the sources of capital that a company uses to finance its operations, weighted by the proportion of each source in the company's capital structure. In other words, it is the average rate of return the company needs to pay its investors and lenders to satisfy their expectations of risk and return.

The formula for calculating WACC is as follows:

WACC = (E/V x Re) + ((D/V x Rd) x (1 - T))

Where:

E = Market value of the company's equity

D = Market value of the company's debt

V = Total market value of the company's capital (E + D)

Re = Cost of equity

Rd = Cost of debt

T = Corporate tax rate

Let's break down this formula into its components:

Cost of equity (Re): This is the expected rate of return that investors require to invest in the company's equity. It is calculated using the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, the market risk premium, and the company's beta.

Cost of debt (Rd): This is the interest rate that the company pays on its debt. It is calculated by considering the risk-free rate, the credit risk premium, and the company's credit rating.

Corporate tax rate (T): This is the company's tax rate on its income. It is used to adjust the cost of debt because interest payments are tax-deductible.

Market value of equity (E): This is the total value of the company's outstanding shares, calculated by multiplying the number of shares by the current market price.

Market value of debt (D): This is the total value of the company's outstanding debt, including both short-term and long-term debt.

Total market value of capital (V): This is the sum of the market value of equity and the market value of debt.

Using this formula, a company can determine its WACC, which represents the minimum rate of return that it must earn on its investments to satisfy its investors and lenders.

In conclusion, WACC is a crucial financial metric that helps companies make informed decisions about their financing options. By calculating WACC, a company can determine the cost of its capital and use this information to evaluate potential investments and determine the most cost-effective way to finance its operations.

Why do M&A deals fall apart?

Mergers and acquisitions can be complex and involve many potential issues that cause deals to fall apart. Some of the main reasons why M&A deals may fall apart include:

1. Valuation Differences: One of the most common causes of M&A deal failure is a disagreement over the valuation of the target company. The deal may fall apart if the buyer and seller cannot agree on a fair price.

2. Due Diligence Issues: During the due diligence process, the buyer will typically conduct a thorough review of the target company's financials, operations, and legal and regulatory compliance. If issues are uncovered that were not disclosed before, the buyer may become concerned about the target company's financial health or legal liabilities, leading to a failed deal.

3. Financing Problems: M&A deals often involve large sums of money, and securing financing can be complex. The deal may fall apart if the buyer cannot secure the necessary financing.

4. Bad Fit/Cultural Differences: M&A deals often involve companies with different cultures and business methods. If the two companies are fundamentally incompatible, it may be challenging to integrate them successfully, leading to a failed deal.

5. Regulatory Issues: M&A deals may be subject to regulatory approval, and if the necessary approvals are not obtained, the deal may not be able to proceed.

6. Management Conflicts: M&A deals can involve significant changes to the management structure of the target company, which can lead to conflicts between existing management and the new owners. If these conflicts cannot be resolved, the deal may fall apart.

7. Economic Environment: Economic conditions can change rapidly, and if market conditions deteriorate, it may become difficult or impossible to complete an M&A deal.

In conclusion, the success probability of M&A deals can vary widely depending on several factors. Some studies suggest that only about half of all deals are successful, while others indicate a success rate of around 70-80%. In any event, having an M&A advisor by your side is crucial to increase the chances of a successful outcome and mitigate the potential risks that are under your control.

Strategic vs Financial Buyers: Who To Sell To?

When selling your business, keep in mind the two kinds of buyers you can sell to: strategic or financial.

A strategic buyer is a company in your industry or related industry that wants to acquire your company for strategic reasons such as increasing market share, achieving economies of scale or entering into a new market. Most mergers occur when a company buys out a smaller competitor or niche player in the same industry.

Strategic Buyers: Pros & Cons

Strategic buyers differ from financial buyers in that they intend to integrate the new company with their existing business. For example, a regional bank might acquire a small independent bank outside its territory to expand its footprint. Its motivation for buying it isn’t purely financial like a private equity firm, which can lead them to make higher offers. However, a seller must be mindful when working with a strategic buyer, as the table below shows:

While the appeal of a strategic buyer offering more cash upfront is clear, one must be mindful of the downside scenarios. Alternatively, financial sponsors tend to offer business owners a path to maximize value alongside them.

Financial Buyers: Pros & Cons

While strategic buyers are interested in integrating sellers into their existing corporate entity, financial buyers are more interested in growing profit in the short term in preparation for an eventual sale. Naturally, this goal impacts the experience of the seller. To summarize:

When working with a private equity (PE) firm, you may have to wait longer to get paid, but the potential reward down the line could be bigger. This is why PE firms usually pay higher sale prices (cash + equity) than strategic buyers. In the last five years, this difference has become even more noticeable.

Regardless of the type of buyer, it's crucial to have a reliable M&A advisory firm to negotiate the deal. This is especially important when dealing with PE firms, which can be more complex.

Source: First Page Sage, Insead.

Navigating the Five Phases of a Sell-Side M&A Process

The process of selling a company typically involves five phases, and the role of an M&A advisor is crucial.

Phase I: Company Assessment and Valuation

Advisor Role: Perform a comprehensive analysis of the company's financials, operations, and market position to determine its overall value.

Financial analysis helps understand a company's financial health and identify potential risks and opportunities. Assessing a company's operations and market position is crucial to determine its sustainability, profitability, and valuation range.

DCF, or Discounted Cash Flow, is a valuable tool for M&A professionals to determine a company's present value. It considers factors like the time value of money, growth rate, risk, and inflation to provide an accurate estimate of a company's future cash flows in today's dollars. This method helps buyers make informed investment decisions by providing a comprehensive analysis of the company's financial health and growth prospects.

Phase II: Preparation of Marketing Materials

Advisor Role: Creation of teaser and confidential information memorandum for distribution to potential buyers.

An information memorandum is a vital part of presenting a company's strengths and growth prospects to potential investors or buyers. It should contain detailed financial and market information, the management team's experience, and the vision for the company's future. It can help attract investors and buyers by mitigating risks and addressing potential concerns, ultimately creating a compelling picture of the company's potential for success.

Phase III: Identifying Potential Buyers

Advisor Role: Develop a list of interested parties and confidentially approach them.

Developing a list of potential interested parties involves identifying individuals, organizations, or businesses that have shown interest in a specific product, service, or opportunity. The approach to these parties must be done confidentially to protect sensitive information. The purpose is to gauge interest and potential partnerships, collaborations, or investments that could benefit all parties involved.

Phase IV: Negotiations

Advisor Role: Facilitating negotiations between the seller and prospective buyers to arrive at mutually agreeable terms.

The advisor uses their expertise to guide various aspects such as valuation, deal structure, and other relevant factors affecting the transaction. They also help to manage the emotions and expectations of both parties to ensure that the negotiations remain constructive and that the deal can be closed successfully. Ultimately, the M&A advisor's goal is to ensure that the transaction is completed fairly and beneficially for all parties involved.

Phase V: Due Diligence, Contract Drafting, and Closing

Advisor Role: Facilitating the buyer's due diligence process and assisting legal counsel with contract drafting and closing.

The sell-side due diligence involves a thorough examination of a company's financial, legal, and operational records by potential buyers. The process helps buyers understand associated risks and make informed decisions. Sell-side advisors assist by preparing data rooms, responding to buyer questions, coordinating with the management team and other advisors, and negotiating the transaction terms.

In conclusion, if you are a business owner and have been contemplating selling your business, or if a potential buyer has approached you, it is essential to seek assistance from a professional M&A advisor. An M&A professional can provide you with comprehensive guidance, support, and expertise to help you navigate through the complexities of the selling process. They can help you evaluate your business's value, identify potential buyers, negotiate favorable terms, and ensure a smooth transaction. With their knowledge and experience, an M&A advisor can help you maximize the value of your business and achieve your desired outcomes.

Unlocking Value in Lower Middle Market M&A

Lower middle market transactions (enterprise value between $5 million and $100 million) can offer significant value for investors and buyers. These transactions can be attractive for several reasons, including lower valuations, strong growth potential, and the ability to add value through operational improvements or synergies with existing businesses. For example, a private equity firm may acquire a company and utilize its expertise and resources to improve the company's operations, expand its product offerings, or enter new markets. Similarly, a strategic buyer may acquire a company that complements its existing business, providing opportunities for cost savings or revenue growth.

Furthermore, these acquisitions offer investors and buyers the ability to work closely with management teams and have a more hands-on approach to the investment. This can provide greater transparency and control over the investment, allowing investors and buyers to make strategic decisions that can drive growth and increase value.

Why an M&A advisor is vital for selling your business.

When contemplating the sale of a business, the process can be both intricate and emotive. Therefore, it is imperative to consider enlisting the services of an M&A (mergers and acquisitions) advisor. Engaging an M&A advisor can provide invaluable guidance and expertise throughout the transaction, assisting in navigating the highs and lows of the process.

One of the principal benefits of hiring an M&A advisor is their ability to assist in the maximization of the business's value. This is accomplished through the performance of a comprehensive valuation of the company, identification of potential buyers, and skillful negotiation on behalf of the seller to ensure that the best possible deal is achieved.

Furthermore, the emotional aspect of selling a business can be challenging, as entrepreneurs may have dedicated substantial personal time and energy to building their company. An M&A advisor can offer an impartial viewpoint, enabling informed decision-making and the avoidance of emotional pitfalls.

In conclusion, retaining the services of an M&A advisor is a vital step when planning the sale of a business. An M&A advisor can deliver valuable guidance and expertise, aiding in the management of the intricate transaction process and the optimization of the business's value.